GetHired is the Best Way to Hire Employees and Save Thousands of Dollars in Taxes.

Select Category

Please enter missing

details.

Partner Referral

Partner Referral

| Users | Bulb | Salary |

|---|---|---|

| 1 New Hire Per Year | $2,400 Average Tax Credit Savings / New Hire | $2,400 in Tax Credits Per Year |

| 5 New Hire Per Year | $2,400 Average Tax Credit Savings / New Hire | $12,000 in Tax Credits Per Year |

| 15 New Hire Per Year | $2,400 Average Tax Credit Savings / New Hire | $36,000 in Tax Credits Per Year |

| 25 New Hire Per Year | $2,400 Average Tax Credit Savings / New Hire | $60,000 in Tax Credits Per Year |

| 50 New Hire Per Year | $2,400 Average Tax Credit Savings / New Hire | $120,000 in Tax Credits Per Year |

Tell us about a time that you delighted a customer.

Why would you be an ideal candidate for this position?

Tell us about an experience that you’ve had that relates to this position.

How many years of sales experience do you have?

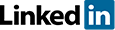

GetHired automatically screens every candidate for work opportunity tax credit eligibility, which can save your business up to $9,600 in tax credits per new hire. GetHired can also manage all of the paperwork to help you file your tax credit.

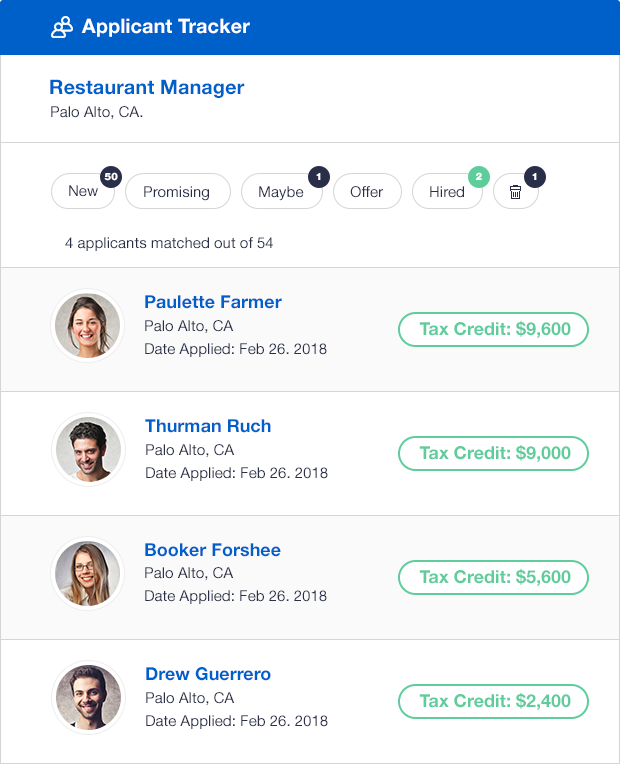

New hires can complete their I-9, W-4, employee handbook, bank details, and any custom onboarding documents you might have through the GetHired electronic onboarding platform.

GetHired is fully integrated with the USCIS E-Verify program and allows you to ensure a

legal workforce.

You can also order background checks

through our integrated background check provider.

Save Time and Thousands of Dollars Per Year With GetHired

| Feature |  GetHired GetHired |

|---|---|

| Post to multiple job boards & social media sites in one click | Yes |

| Electronic onboarding | Yes |

| Custom onboarding documents | Yes |

| Searchable resume database | Yes |

| Pre-screen candidates with video & audio | Yes |

| One-click apply with LinkedIn, Monster and Facebook | Yes |

| Automatically schedule interviews with candidates | Yes |

| Display work opportunity credit values in applicant tracking system | Yes |

| Automatically identify candidates who live in Rural Communities ($2,400 tax credit per employee) |

Yes |

| Automatic alerts when employees meet threshold requirements and qualify for tax credits | Yes |

| Video Conferencing | Yes |

| Customizable and hosted careers page | Yes |

| E-signature of Form 8850 | Yes |

| E-signature of Form 9061 | Yes |

| Automatically create tax packet to file Form 5884 to claim credit | Yes |